Big Story:

-

Covid-19: Impact on Microfinance Sector. Read More...

-

Indian Micro, Small & Medium Enterprises (MSME) and Impact of COVID-19 Read More...

-

Indian Leather and Sports Goods Industries and Impact of COVID-19 with Market Experts Read More...

-

Automobile firms to require Rs 3.5 lakh crore capital expenditure to realise government’s EV Vision 2030 Read More...

MFI Grading

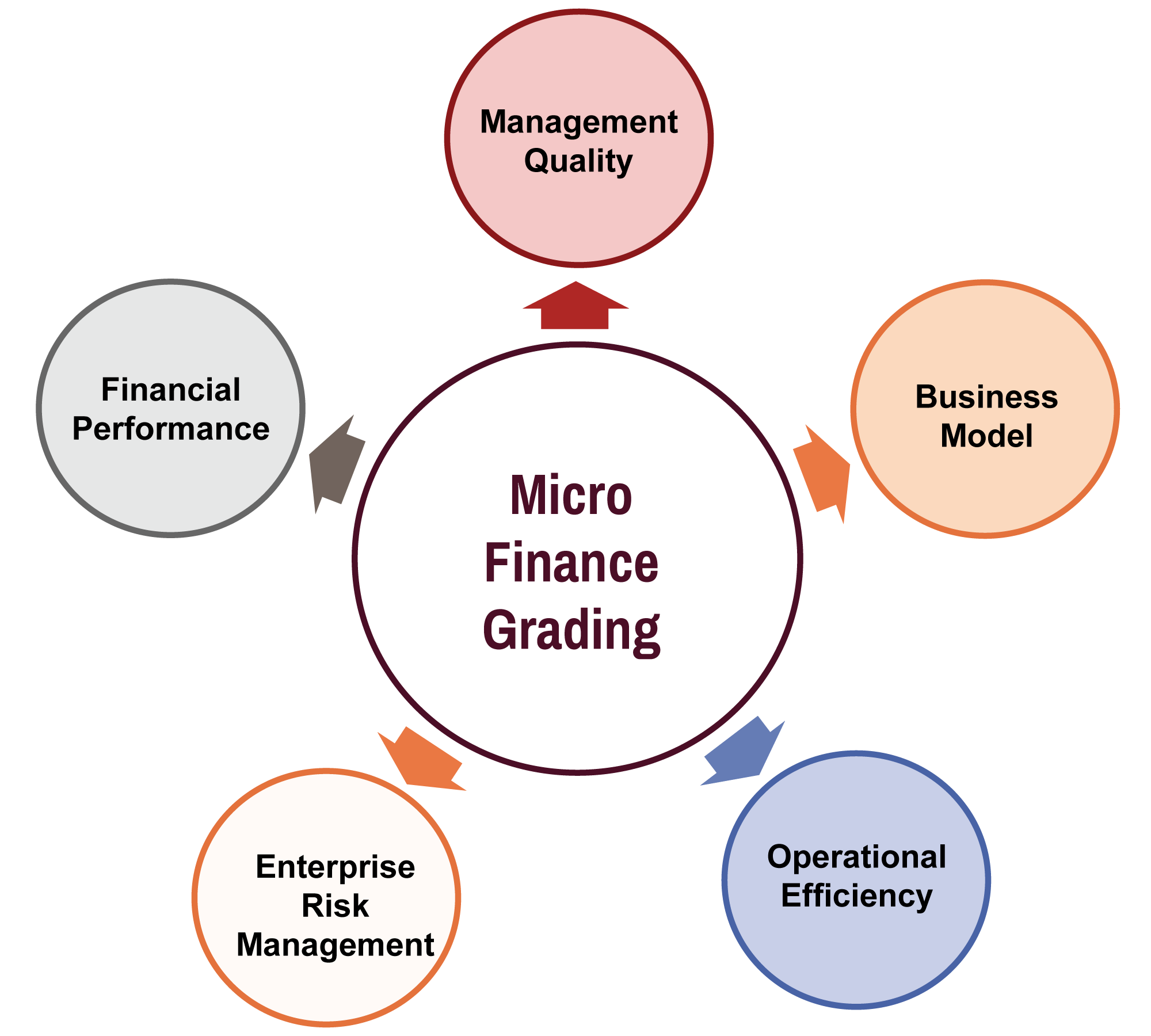

Grading Criteria and Scale

Criteria

Management Quality: The quality of the management at the MFI is assessed by

- Understanding the experience of the management in this field,

- Business Strategies and Financial and accounting policies

- Corporate Governance Policies and Processes

- The management’s stability and inclusion/exit of key management personnel

- Vision and Social Impact expected to be achieved through operations.

Business Model: The ability of the company to reach a relatively large number of clients, district operated in and penetration of financial services, in maintaining portfolio diversity with respect to amount and geography, its ability to manage its systems and processes efficiently, links with corporate bodies to promote corporate social responsibility, training its personnel adequately etc. will be understood. The company’s borrowers could fall into the SHG/JLG/combination and the method of interaction with borrowers, recovery and collections etc. will contribute towards operational sustainability and efficiency.

Operational Efficiency: An MFI has to battle higher operational costs per customer than traditional institutions such as banks due to smaller ticket sizes. Reducing this transaction cost by harnessing technology in its systems allows for efficient and profitable operations.

- Use of technology for business, cost per client, profitability per employee and branch will be considered while determining the operational efficiency of the MFI.

- The company’s ability to manage its funds, source of funds, can be indicative of the underlying strength or weakness of the operations of the company.

Enterprise Risk Management: Risk Management for the MFI becomes essential considering the nature of the business it is in (MFI loans are extended without collateral). Risk Management is analyzed in terms of

- Independent risk management division and independent internal audit

- Monitoring and supervision

- Loan sanction and disbursal policies

- Management of credit, market and operational risks

- Management of legal and compliance risk

- Fraud detection and management

- Reputation and strategic risks

Financial Performance: The The financial performance of the company is measured in terms of Capital Adequacy and the components of capital, Portfolio at Risk (PaR) at different levels (PAR for 1 day, PAR for 1 week and PAR for 1 month), Risk Coverage Ratio, Provision Expense Ratio, Operating Expense Ratio, Write-Offs, Cost of Funds, Net Interest Margin, Debt Equity Ratio, Return on Equity, Return on Assets etc. The ALM position of the company is also understood to determine any liquidity concerns that may arise.

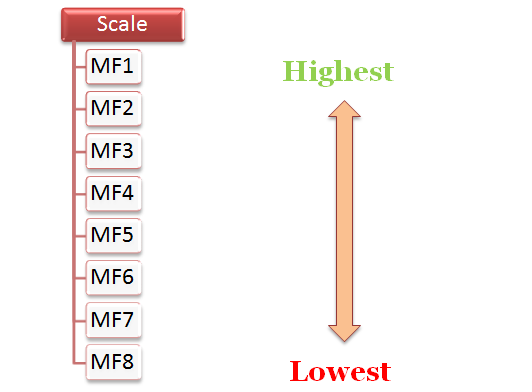

SCALE