MFI Grading

Overview

Microfinance Institutions (MFIs) cater to the population that characteristically would not be eligible for financing from banks and big financial institutions; MFIs lend to them at lower rates than the local moneylenders. The socio-economic role played by MFIs thus, makes them an integral part of the financial structure of India. In line with its objective to help markets function better, B2K Analytics offers “MFI Grading” as a part of its products and services to this sector; an MFI grading is a reflection of the sustainability of the operations of the Micro Finance Institution.

The Need for Micro Finance Grading (MFI)

Micro Finance Institutions, by nature of their operations, face high operational costs. In order to be sustainable, they need to

- Be operationally efficient

- Conduct a business while meeting the margin cap set by the regulator

- Infuse funds to meet the Minimum Net Owned Fund(NOF) requirements

- Be able to convince lenders that their operations are sustainable and profitable.

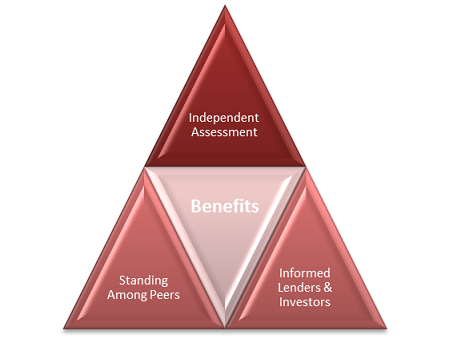

Benefits

- A third party independent report on its operations, strengths and weaknesses

- A benchmark with its peers in different geographies

- An independent report that it can use as a part of its interactions with lenders and investors